Trading just under $250.00 — not far off from its 52-week peak of $251.48 — Broadcom (NASDAQ:$AVGO) is performing well overall against both the market and its competitors. Climbing an upward trend, its favorability among investors is, in part, fueled by current buzz surrounding the company. But how do its current price and company developments fare with long-term investors? Broadcom’s price ratios play a large role in determining whether long-term investors choose to trade with the company and to what extent.

Short-term investors generally focus on price volatility, while long-term investors need to assess a company’s fundamental value, judging whether a stock’s price accurately affects the underlying value of the stock itself. Analyzing Broadcom’s price ratios yields an idea of the relation between its listed price and its fundamentals (i.e. earnings, cash flows, sales).

Price-to-earnings ratio

The price-to-earnings ratio (PE ratio) is a crucial tool in evaluating the true value of a share. A stock’s earnings per share (EPS) is made known to shareholders after a company deducts its expenses.

AVGO reported a PE ratio of 15.6x as of August 17, 2017, outperforming its competitors Qualcomm (NASDAQ:$QCOM) at 12.5x, and Intel (NASDAQ:$INTC) at 11.7x. Texas Instruments (NASDAQ:$TXN), however, won out with a PE ratio of 19.4x.

While AVGO’s PE ratio is undervalued to the semiconductor industry standard of 24.2x, and the U.S. market overall average of 23.6x, AVGO shows strong potential for growth while it managing to outplay a fair number of competitors.

Price-to-sales ratio

The price-to-sales ratio (PS ratio) of a company indicates the amount investors are willing to invest per dollar of sales. As of August 17, 2017, AVGO beat out competitors with a PS ratio of 6.1x—over TXN’s 5.6x, QCOM’s 3.4x, and INTC’s 2.7x.

Predictions for continued growth in automotive, industrial, and network infrastructure areas, have garnered optimism for both AVGO’s and TXN’s sales outlook. Intel is not being looked at so favorably by investors mainly because of business transition issues, while QCOM is currently experiencing disfavor due to restricting licensing issues with Apple (NASDAQ:$AAPL).

Price-to-EBITDA ratio

A company’s price-to-EBITDA (earnings before interest, tax, depreciation and amortization) ratio, reveals how overall value is affected by operating decisions. AVGO and INTC, in particular, are currently saddled with have huge debt levels, which result in higher interest expense.

AVGO’s price-EBITDA ratio was 16.6x as of August 17, 2017—higher than QCOM’s 11.4x, TXN’s 11.9x, and INTC’s 6.7x. QCOM’s ratio relatively higher ratio was ultimately affected by the fact its stock price fell below earnings, while merger synergies greatly increased profit margins for AVGO and TXN.

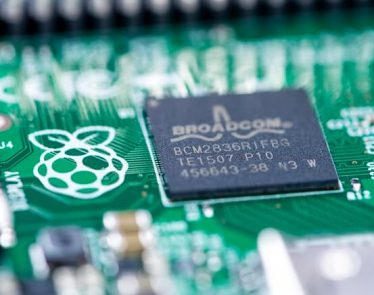

Featured Image: depositphotos/serggn