Microsoft Corporation (NASDAQ:MSFT) shares are trading around an all-time high of $105 today following a stunning rally of 41% in the last twelve months. The company’s market capitalization has also surpassed the $800 billion level for the first time in history, which puts it behind only Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) in market cap.

MSFT shares are likely to extend this momentum in the following quarters, especially considering its robust financial numbers for fiscal 2018 and a robust outlook for fiscal 2019.

JP Morgan analyst Mark Murphy says that Microsoft will be the leader in the Enterprise and that it will profit from a broad range of cloud solutions. The LinkedIn and GitHub acquisitions will also be among the most significant catalysts for Microsoft’s share price appreciation.

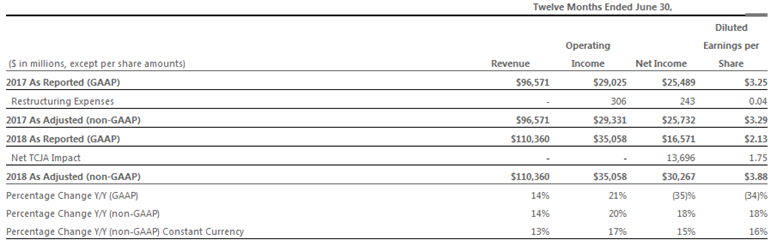

Sales Exceed the $100 Billion Level

Microsoft’s consolidated annual sales crossed the $100 billion level for the first time in history in fiscal 2018. The substantial growth in its cloud revenues, as well as the double-digit growth from its Personal Computing and Productivity and Business Processes segments, led it to generate a record revenue in fiscal 2018.

Satya Nadella, the chief executive officer of Microsoft, said, “Our early investments in the intelligent cloud and intelligent edge are paying off, and we will continue to expand our reach in large and growing markets with differentiated innovation.“

Microsoft’s commercial cloud business contributed more than $23 billion in consolidated revenue last year, and the company signed several multi-million-dollar commercial cloud agreements the previous year.

Microsoft Corporation Expects to Extend the Momentum

Microsoft management anticipates double-digit revenue growth from all business segments in fiscal 2019—which could offer significant support to its share price momentum. Cash returns from the fourth largest company would also help in boosting traders’ sentiments.

The company plans to make a high mid-single-digit growth in its quarterly dividends. By and large, Microsoft appears to be a solid play for both dividend and growth investors.

>> Alphabet Inc. Partners with Telkom to Deploy Internet Balloon in Kenya Next Year

Featured Image: Twitter