With earnings season in full swing, Facebook (NASDAQ:$FB) is set to release its 2Q17 earnings on July 26th. Routinely beating analyst estimates in the last several quarters, Facebook has positioned itself as a prolific performer.

Last quarter, Facebook posted Earnings Per Share of $1.04, representing a 73% year over year increase from the $0.87 posted in 1Q16. With first quarter revenues hitting $8 billion, Facebook increased their revenues by nearly 49%, smashing analyst expectations of $7.8 billion.

What Investors Should Watch For in 2Q17

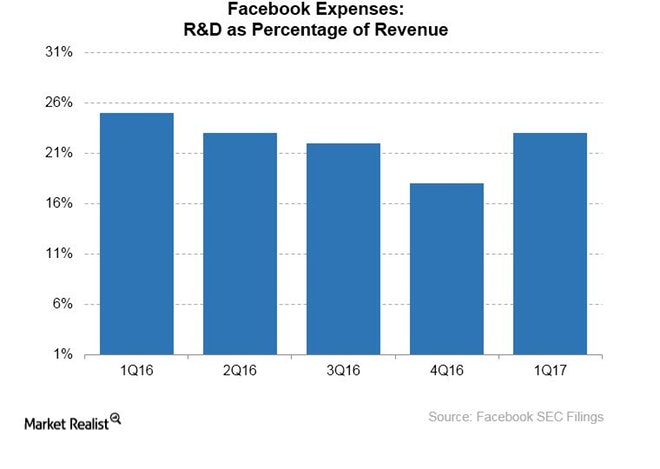

Of course, factors such as cost efficiency and competition intensity will affect Facebook’s performance, and determine whether it will beat or miss analyst expectations. Research and Development (R&D) is a crucial factor to watch, as it is the largest allocation of Facebook’s operational costs, accounting for 23% of revenues in 1Q17.

Despite persisting as the obvious leader in the world of social media, Facebook has lost some dominance to competitors such as Twitter (NYSE:$TWTR), Snap (NYSE:$SNAP), Microsoft’s Linkedin (NASDAQ:$MSFT), and Google (NASDAQ:$GOOGL).

Competition affects Facebook in a few different ways, primarily in user attention, and the platform’s ability to attract and retain users. However, the loss of user attention also throws advertisement dollars, and thus revenue into the equation. As advertisers look for the platform that reaches the most users, increased competition could drive up marketing expenses and cut into operating margins. With marketing and sales expenses already accounting for 13% of Facebook’s revenues last quarter, this wouldn’t be an ideal situation.

Analysts Believe Facebook Could Be Set To Soar

As mentioned, Facebook has performed extremely well, despite increasing pressure. Following a strong first quarter performance, analysts are expecting Earnings Per Share from Facebook in 2Q17 to increase to $1.11. If reached, this would be an enormous improvement from an Earnings Per Share ratio of $0.71 reported just last year in 2Q16.

Additionally, Facebook posted 2Q16 revenues just a little over $6.4 billion, and is expected to report revenue of $9.2 billion for 2Q17. When put into perspective, this is almost a 44% year-over-year increase.

As mentioned prior, Facebook has consistently topped Wall Street analyst estimates, recording surprises of 17%, 11%, 9%, and 5% on the past four quarterly estimates. Despite such strong historical performance, analysts still believe the stock price is “reasonable” at 32x forward earnings.

While Facebook is performing well, the social media platform’s true appeal is set to come in 2018, when double-digit growth is expected. However, Facebook must first maintain its status as a robust performer by once again beating analyst estimates for 2Q17. If Facebook is able to beat another quarter of estimates, this implies that things are going according to plan, and investor confidence should continue to propel Facebook shares.

As Erin Gibbs, a portfolio manager with S&P Global suggested on CNBC, investors should seek adding Facebook to their portfolio before the company’s earnings release on July 26th:

“This period of temporary lowered outlook and lowered valuations seems like a decent place to get in before [Facebook] starts showing Wall Street they have underestimated one of the better-managed companies in tech.”

Featured Image: Depositphotos/© PromesaStudio